Thinking in Decades & Deliberate Slowness

Moving fast vs sustainable growth, deriving insights from the lives of legends in each field, and much more.

Founders Podcast

This week, I listened to David Senra’s episode of Michael Jordan on Founders podcast. I have been watching The Last Dance on Netflix over last few weeks, and also watched the movie *AIR*. So, the podcast episode was a very good summary/reminder pulling together from both, based on his biography.

The fascination with Michael Jordan and Kobe Bryant started for me after reading Tim Grover’s books *Winning* and *Relentless*. Tim Grover coached Michael, Kobe, and several other legendary players. The philosophy that I came across on these books (belief before ability) was so fascinating that it reminded me of what I wished I was like.

Ever since discovering them, it’s been about studying them whenever I can, and incorporating any and all insights from those studies into my life.

Trading is a performance sport like any competitive sport. While it’s not as physically demanding, I think it takes a certain kind of crazy self-belief combined with work-ethic and discipline to pull off what’s impossible for an average person. Instead of flying blind, studying what people in other fields who excelled at the top 1% level have done will definitely help give a leg up wherever we are going.

If this is the first time you’re hearing of the Founders Podcast, you should definitely check it out. Unlike most other podcasts, it’s David directly talking to you, and that too with such passion that you get very excited to learn. Every single episode has something you can take away that will improve your mind, life, and performance. Definitely check it out!

My favourite was the episode on Rockefeller’s letters to his son.

Slow over Fast

Another key insight that repeated over and over throughout the episodes of Founders podcast and also resonated a lot with me and my experience so far: thinking in decades instead of months or years. Sure, moving fast and breaking things sounds exciting. It’s a venture capital worldview. Fast is the most desired mode for anything in this world. In a world where Fast is rewarded, we are blind to see those who break beyond the level of fixing while moving fast. I think I am coming around to the philosophy of Slow. If you have come to a place in life where you know what you want to do for the rest of your life, there’s no point in fussing about speed.

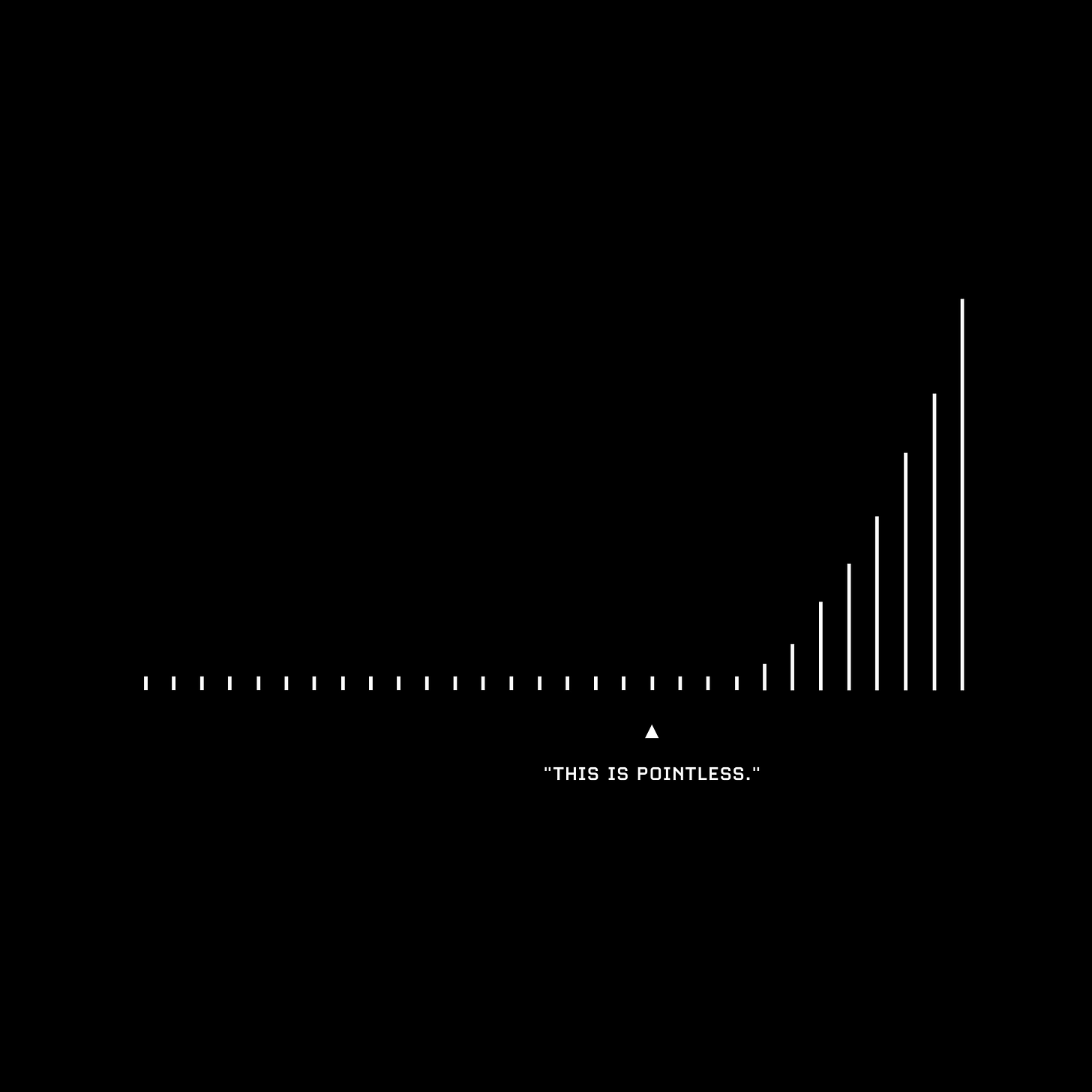

Ironically, the more deliberately you slow yourself down, and take well thought out steps, your progress speeds up exponentially. This is very hard to understand at first, but as you experience this paradox in real-life, you begin to draw parallels.

In trading, those who want fast growth usually end up blowing out. Speed is often accompanied with a very small room for error. More often than not, what can go wrong does go wrong. Some of the rare historically successful traders have been fortunate enough to have recovered from blowing up their capital seeking fast growth. But that’s the case with exceptions - they aren’t examples. Most people who blow up their accounts never recover from it - both professionally and psychologically. And markets are very strict. They lure you to scale up, you end up scaling your mistakes when you scale up before you’re truly ready, and what can go wrong does go wrong at your highest scale to date.

In roaring and very opportunistic markets, one might see their peers making fortunes by taking mindless risk. Market forgives the mistakes made, and so many traders end up mistaking it’s their skill. Eventually they grow so fast, and as with everything, what goes up to bubble territory usually comes down rather disastrously. We have heard such stories from Dan Zanger to Livermore - of people who gave back nearly everything they made during their ascent.

When you grow slowly, and you’re deliberately growing slowly - focusing on being desperate for growth and speed with improving your process rather than outcome, eventually it builds up over years and even exponential growth becomes one that’s sustainable - just like charts where years of consolidation or small steps takes the chart to a place where preparation meets opportunity and there’s exponential growth which sustains and consolidates near the top for the further leg of upmove.

Slow is fast if you think in decades - slow with outcome expectations, fast with process improvements - results in sustainable overall growth.

Keep learning, keep pushing. If you haven’t found what you want to do for the rest of your life, keep exploring. If you have found, commit to becoming the very best at it, and go at it with absolute peak confidence each day.

That’s what I am working on now - to bring peak confidence each day and focus on process improvements, no matter how small they are. Results will come.

Whatever you want - in terms of outcome, it will take less time than the worst you can imagine, but it will definitely take more time than you want.